Worksheet Enter your state and local general sales taxes paid on specified items if any. Some of the worksheets displayed are 2017 publication 17 Quick nder Deductions form 1040 itemized Tax deduction locator irs trouble minimizer Standard deduction and tax computation Itemized deductions work 2017 booklet 3805z enterprise zone business booklet Quick.

Publication 600 2006 State And Local General Sales Taxes Internal Revenue Service

Irs Form 1040 Hsa Deduction.

Irs general sales tax deduction worksheet. Tax information documents Receipts Statements Invoices Vouchers for your own records. General Sales Tax Deduction Income Worksheet. This drops to just 5000 if youre married but.

Here are some tips for answering the questions. The IRS allows for a deduction of sales and use tax paid as an option for those who itemize their deductions letting them choose between deductions for state and local income taxes or state and local sales and use taxes. To figure the amount of optional general sales tax you are eligible to claim just answer a few questions and the system does the rest.

State and Local General Sales Tax Deduction Worksheet Instructions. This session will expire after 20 minutes of idle time if your session. Allow approximately 5-10 minutes to complete this tool.

Be sure to check the box on that line. Irs Form 1040 General Sales Tax Deduction Worksheet. 20 rows General Sales Tax Deduction Income Worksheet for use with IRS Sales Tax Calculator.

Sales Tax Deduction Calculator. Some of the worksheets for this concept are 2017 publication 17 Quick nder Deductions form 1040 itemized Tax deduction locator irs trouble minimizer Standard deduction and tax computation Itemized deductions work 2017 booklet 3805z enterprise zone business booklet Quick facts work where to file. Irs Form 1040 Health Savings Account Deduction Form 1040 schedule C Profit Or Loss From Business sole In Irs Form 1040 Schedule C Tax Deduction Worksheet Template.

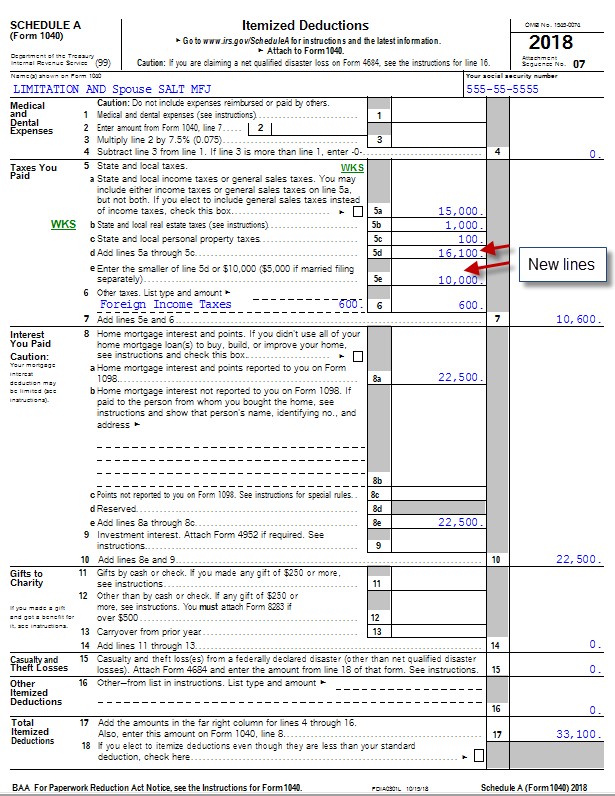

The Tax Cuts and Jobs Act TCJA limited state and local tax SALT deductions when it became effective in 2018. For use with IRS Sales Tax Calculator Clear and reset calculator. Otherwise reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal andor State return.

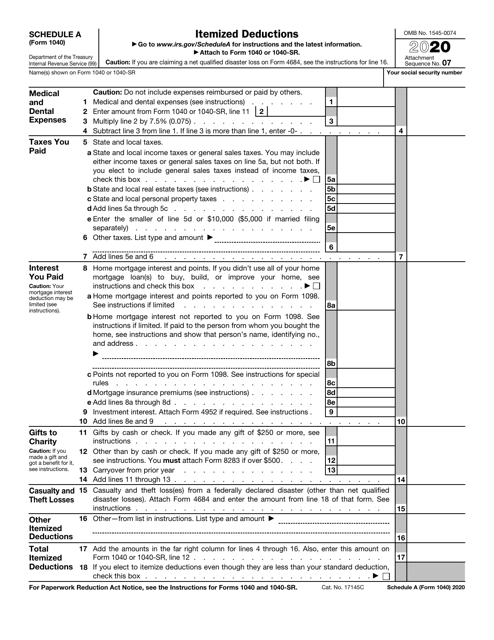

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. You may need to look up the sales tax that could have been deducted using the IRS sales tax calculator. State and Local General Sales Tax Deduction Worksheet See the instructions that begin on page 3 Instructions for the State and Local General Sales Tax Deduction Worksheet.

Enter on line 7 any state and local general sales taxes paid on the following specified items. Irs Form 1040 Health Savings Account Deduction. Add lines 1 6 and 7.

See the instructions for line 7 of the worksheet Deduction for general sales taxes. 21 Posts Related to Irs Form 1040 General Sales Tax Deduction Worksheet. Itemized Deductions Worksheet You will need.

2017 General Sales Tax Deduction Showing top 8 worksheets in the category - 2017 General Sales Tax Deduction. Using the Sales Tax Deduction Calculator. Print a taxpayer copy.

Instructions for the State and Local General Sales Tax Deduction Worksheet. Enter the result here and the total from all your state and local general sales tax deduction worksheets if you completed more than one on Schedule A line 5a. Number of Exemptions line 6d.

What if your local general sales tax rate changed during 2006. Youre limited to no more than a 10000 deduction regardless of whether you claim income taxes or sales taxes. If you are completing more than one worksheet include the total for line 7 on only one of the worksheets.

Add lines 1 6 and 7. Use a copy of the taxpayers previous year return to. Enter the result here and the total from all your state and local general sales tax deduction worksheets if you completed more than one on Schedule.

In order to help you determine your Sales Tax Deduction we will ask you a series of questions. Taxpayers can deduct either the amount of state and local income tax they paid or the general sales tax rate plus any general sales tax paid on specified items see the sales tax worksheet line 7 instructions for a list of specified items. October 29 2018 by admin.

Enter on Line 7 any state and local general sales taxes paid on the following specified items. Deduction for general sales taxes. What if you lived in more than one locality.

First go to the Sales tax Deduction Worksheet. 2017 General Sales Tax Deduction - Displaying top 8 worksheets found for this concept. What if you lived in more than one state.

B elected to deduct state and local general sales taxes instead of state and local income taxes. General Sales Tax Deduction Income Worksheet. If you are completing more than one worksheet include the total for line 7 on only one of the worksheets.

Httpswwwirsgov Use this worksheet to determine the portion of the taxpayers prior year state refund that is considered taxable in the current year. This can be found by following these steps. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately.

Taxpayers will indicate by using a checkbox on line 5 of Schedule A which type of tax theyre claiming. Irs Form 1040 General Sales Tax.

Irs Form 1040 Sb 2021 Tax Forms 1040 Printable

What Business Records You Should Keep For Tax Purposes Small Business Plan Small Business Expenses Business Binders

Http Burgess House Gov Uploadedfiles Optional 20state 20sales 20tax 20tables Pdf

Publication 600 2006 State And Local General Sales Taxes Internal Revenue Service

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Business Tax Tax Write Offs

Getting Your Irs Transcript Is Free Online Here S How To Access Your Account Deductingtherightway Small Business Tax Irs Business Tax

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Home Business Worksheet Template Business Worksheet Business Tax Deductions Small Business Tax Deductions

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

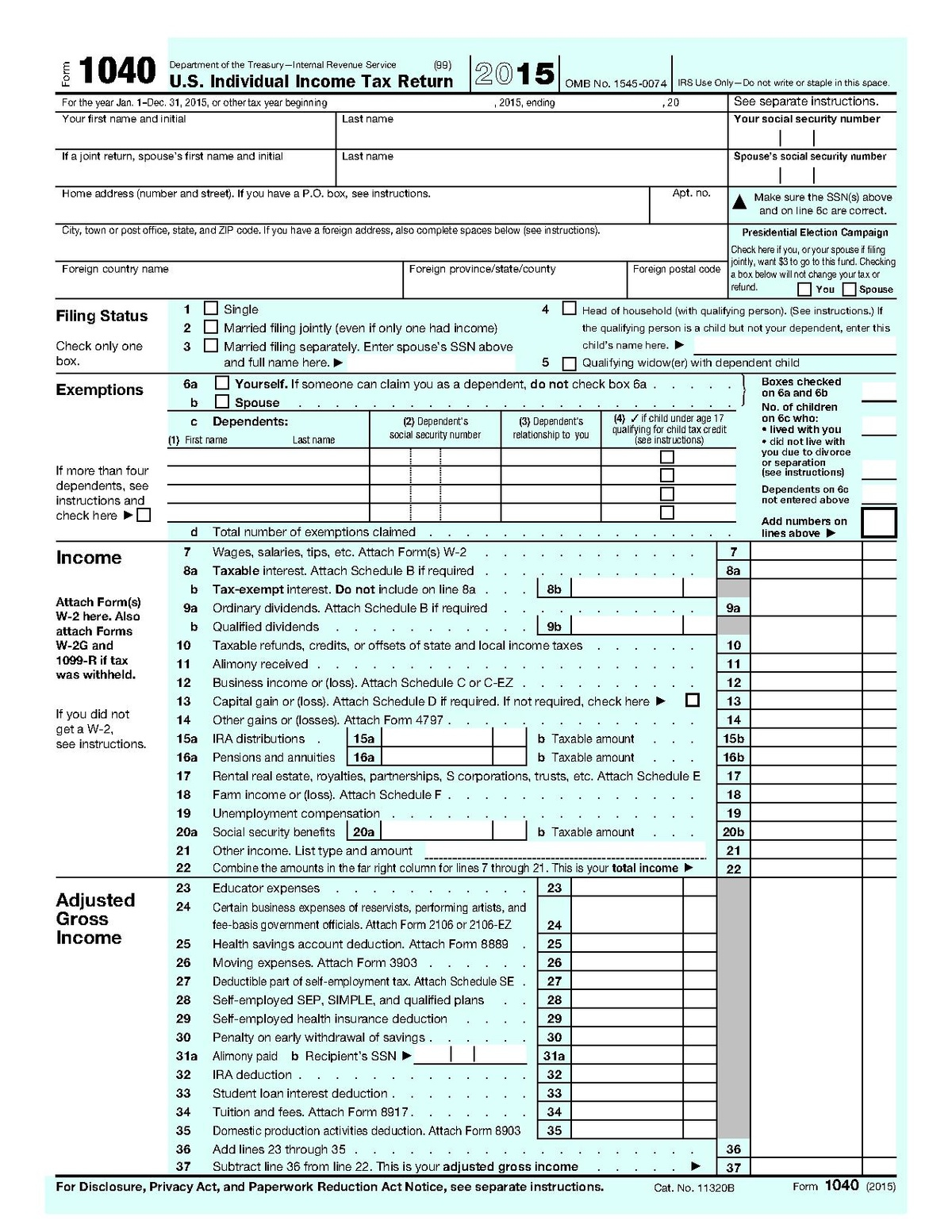

Indie Authors Should Consider Using Schedule C Irs Tax Forms Tax Forms Irs Taxes

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Clothing Donation Tax Deduction Worksheet Printable Worksheets Are A Precious Lecture Room Tool They No In 2021 Donation Tax Deduction Tax Deductions Tax Printables

Form 13 Magi Ten Form 13 Magi Tips You Need To Learn Now Tax Forms Irs Tax Forms Income Tax

Form 1065 Other Deductions Worksheet Deduction Tax Credits Estimated Tax Payments

Publication 600 2006 State And Local General Sales Taxes Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Irs Form 1040 Schedule A Download Fillable Pdf Or Fill Online Itemized Deductions 2020 Templateroller

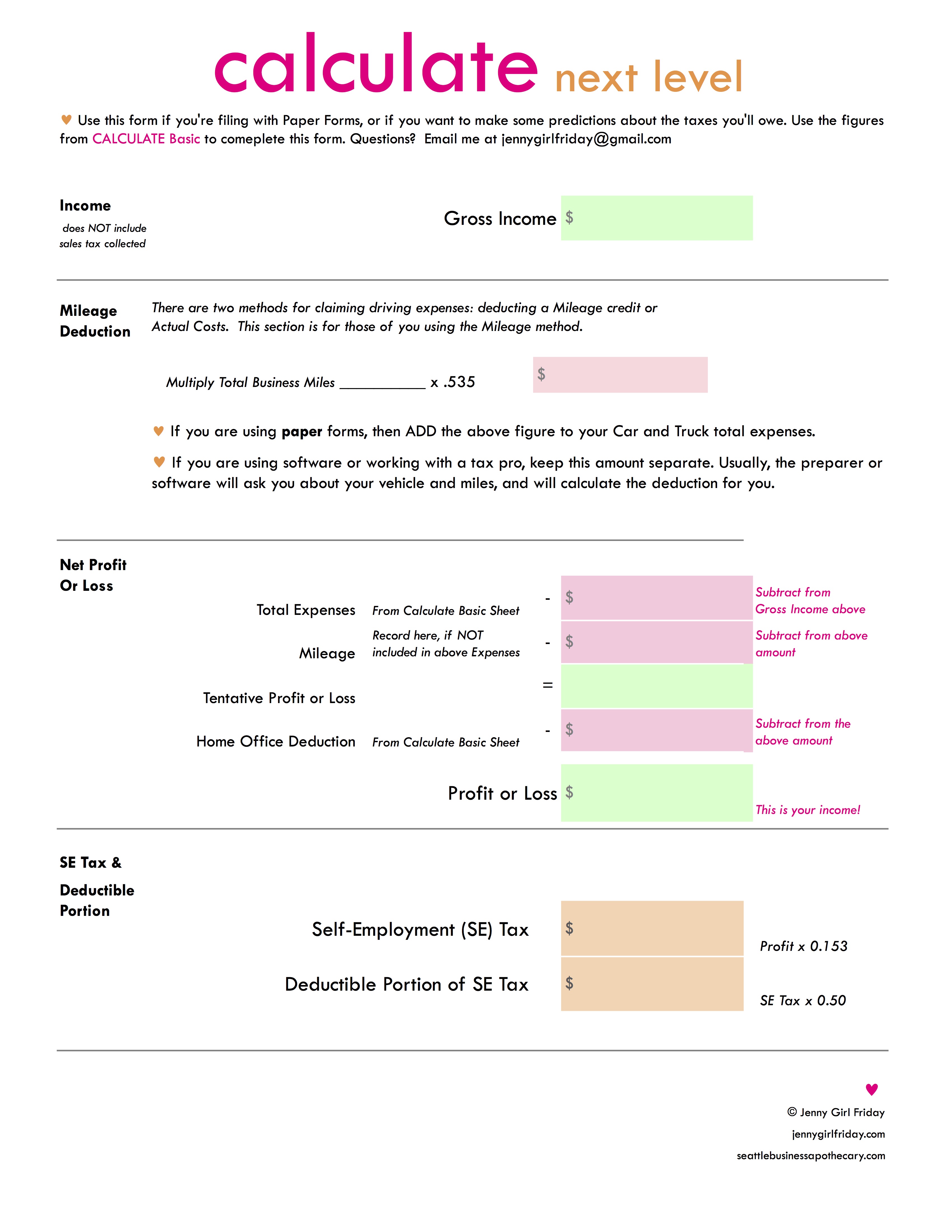

How To Calculate Numbers For Irs Taxes Pen And Paper Spreadsheets Software Seattle Business Apothecary Resource Center For Self Employed Women

How To Calculate Numbers For Irs Taxes Pen And Paper Spreadsheets Software Seattle Business Apothecary Resource Center For Self Employed Women

No comments